As a vacation rental management company in Sarasota, we receive thousands of rental inquiries every year. Many of these inquiries are last minute, with the potential guest offering to book an available property at well below the advertised rate.

What is the opportunity cost to the owner if we don’t accept the offer? More importantly, what is the cost if we do take the offer? How little is too low?

These offers are opportunities for our reservation team to fill gaps in calendars that would otherwise go empty. Sounds good right?

In almost every other real estate category, an owner may think to themselves that, "something is better than nothing" and that every period of vacancy is a lost revenue opportunity. Not vacation rental owners.

Vacation homeowners are different. It’s not just about the revenue for them. Vacation homeowners are emotionally invested in their homes. At Gulf Coast Property Management, we often hear the phrase, “I’d rather the home sit empty than give it away”.

We know that setting and maintaining rental rates is complex. Constantly adjusting to the market in an effort to generate as much revenue for our clients, requires a significant amount of technology, skill, and effort.

Last-minute special, minimum nightly rate, or bottom line; whatever we call it, before considering the offer, we must first determine a realistic minimum nightly rate for the home. A number that makes sense for the market as well as the homeowner.

In the vacation rental world, determining this number is a combination of industry science and the vacation homeowner’s emotions. Let’s start with the science piece first.

Firstly, we establish the accumulated expenses associated with owning the property, and then we divide that amount by the number of nights the property will be available for rent.

The owner’s personal use, friends and family usage, and/or minimum rental restrictions, would all be factors that reduce the nights the vacation home is available for rent.

For example, if you own a vacation home in Venice where the HOA only allows 2 periods of rentals a year, you may determine that a reasonable occupancy level would be 150 days or 5 months. In this instance, you would divide the accumulated costs by 150 to arrive at your minimum nightly rate.

Similarly, if you own a beachfront vacation rental on Siesta Key without any restrictions you may determine a reasonable occupancy goal to be 280 nights. In this instance, you would calculate your minimum rental threshold by dividing your accumulated expenses by 280.

This same rule applies whether we are discussing weekly, monthly, or seasonal rentals. We would just alter the nights that the vacation home is available for rent.

Expenses are split into two categories: Burdened Expenses and Incremental Expenses.

.jpg)

Burdened Cost

Burdened cost is the expenses that an owner incurs regardless of whether anyone is staying in the vacation home. These costs are usually budgeted when you decide to purchase the property. Here is an example list:

- Insurance

- Property Taxes

- Standard Utility Charges

- Maintenance Reserves

- Landscaping

- Pool Maintenance

- Pest Control

For the sake of accuracy, it’s important to use realistic numbers. Just because the home is empty, it does not mean expenses are put on hold. As an example, many homeowners in Florida leave their A/C set to 78F during periods of vacancy. Depending on the age of the system and the size of the house, this practice will still generate a decent size electricity bill, regardless of occupancy.

You may read this list and wonder why I’ve left perhaps two of the biggest expenses out. What are these expenses? Mortgage and HOA Condo Fees.

The reason I have left these items off is that in my mind most vacation rental owners do not choose to purchase their vacation home with investment as the primary motivation. Most vacation homeowners think of their property firstly as a second home and secondly as an investment.

In addition, some HOA or condo dues are simply so high that including them ‘as is’ in the burdened expense list would likely result in the burdened expenses being so high it would make for an unrealistic minimum nightly rate. Similarly, while factoring in debt coverage as an expense is important, there are simply too many variables for it to be a black and white calculation.

Therefore, to at least arrive at a burdened expense ratio, I propose we use a reasonable interest rate calculation based on the value of the property we are attempting to evaluate. On top of this amount, I believe we should add anywhere between 0 and 2% of the value of the property to account for the HOA and condo fees.

The same logic applies if you are fortunate to own the property without any debt. A minimum rental rate reflective of market conditions, should not depend on the amount of debt the property owner is covering.

As a result, here is our revised burdened expense list.

- Adjusted Debt Service/Mortgage (assume an 80/20 Loan to Value at a 5% interest rate)

- Property Taxes

- Insurance

- Condo/HOA Fees (0-2% of property value, dependent on the level of amenities)

- Standard Utility Charges (charges incurred regardless of occupancy)

- Landscaping

- Pool Maintenance

- Pest Control

- Maintenance Reserves

Incremental Cost

Remember those low-ball inquiries I mentioned at the start of this article? If we were to leave the property empty rather than accept a low-ball offer, the owner would not incur any incremental costs. The incremental cost is only incurred when the property is used and occupied. The expenses include:

- Increased Insurance Premium

- Additional utility expenses (charges incurred that are specifically associated with usage)

- Additional wear and tear

Having reviewed hundreds of vacation rental profit and lost statements over the years we have a pretty good idea of what to add to the burdened costs for the incremental portion of the expense ratio.

We typically see a 200% rise in utility costs when the property is occupied.

You can see the burdened cost list is a lot longer than the incremental cost list, and this is typical in all vacation rentals. Actual ownership and running costs, regardless of occupancy are the major factors.

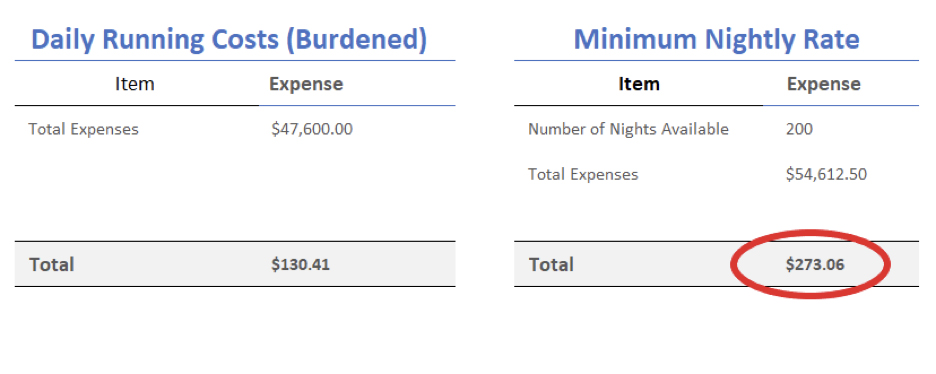

To illustrate the concept we have taken a vacation home in our portfolio and built the calculations out on the tables below.

The vacation home is a single-family pool home in Sarasota. The property is located in a community that provides a good level of amenities, resulting in HOA fees of $4800 per year.

The value of the property is estimated to be around $600K; which based on our 80/20 LTV interest-only rule gives us a monthly interest payment of $2000.

The other expenses have been calculated using our historic data.

For the purposes of this exercise, our rental team has estimated they will achieve 200 nights of occupancy.

Now that we have established our total cost basis, we can move on to calculating the daily running expenses on a burdened cost basis. More importantly, we can establish the total cost of vacation rental ownership on a combined burdened and incremental cost basis.

You can see from the table below that the daily cost of owning the property is $131.41 per day. This is the burdened cost and is the cost of owning the vacation home regardless of occupancy.

The suggested minimum daily rate works out to be close to $275 per night and absent any other factors, $275 is the minimum nightly rental amount we would set the property at. Of course, every dollar we can rent above this amount is essentially more cash to the owner’s bottom line.

The Intangibles

What do we mean by other factors?

When the heart rules the head. Emotions, ego, vanity, call it what you will, vacation homeowners are emotionally invested in their properties. Unlike all other real estate investors, vacation homeowners include their personal feelings when considering rental rates. It’s so much more than a set of numbers for most vacation homeowners.

At Gulf Coast Property Management, we tread a very careful line between maximizing the revenue opportunity for our clients and understanding that occupancy and revenue aren’t always the be-all and end-all.

We also take into account that potential guests should not be educated to believe that the longer they wait the better deal they will get. Guests should understand that there is a floor limit.

As a company, we also have a brand reputation to maintain. Whether it be perception or reality, guests associate the amount paid with quality. We only want to attract quality guests to accommodate the properties we manage.

Unoccupied space is certainly a lost opportunity, however, simply giving nights away to achieve occupancy and reduced revenue is a slippery slope to commoditization.

Just as a Ritz Carlton will forgo revenue to preserve its brand, the vacation rental owner and property manager should understand that setting a high rental rate bar will increase awareness and attract the quality of guests that will treat the property like their own.

Other Considerations

There is an argument to make that if an owner purchased the property primarily as a 2nd home rather than an investment, they would be carrying the burdened expense anyway without the benefit of rental income to offset costs. In this case, capitalizing on high revenue opportunities during peak periods, and not worrying about reduced rates and occupancy during the quieter times, makes sense.

On the flip side, the vacation rental industry has helped many people, purchase and maintain 2nd homes. Many of our clients wouldn’t be able to afford the luxury of a 2nd home without the vacation rental revenue. For these types of owners, it really makes sense to focus on all aspects of the revenue and occupancy levers, as every dollar really does make a difference.

Finally, rarely does a profit and loss statement provide the full investment picture, and we should be reminded that rental revenue is only one element of how the investment is valued. The vacation homeowner also enjoys favorable tax considerations such as depreciation and the ability to write off many of the expenses.

.png)