Although dynamic pricing has been used in most other travel sectors for years, it is a relatively new concept in the vacation rental world.

Have you noticed how air fares or hotel prices constantly change depending on how far in advance you book or events that are going on in the area? These are examples of dynamic pricing in action.

At Gulf Coast we firmly believe it is our approach to revenue management that sets us apart from our competitors and generates significantly more revenue for our clients.

Three Approaches to Rate Management

Fixed Pricing

The Fixed Pricing Strategy is the approach most commonly used in our region. As you can see in the table below, every night is priced at the same rate. A slight variant to this approach is the simple peak or off peak which splits the year into 2 distinct periods These strategies are woefully outdated.

The model under prices peak periods and over prices the off-peak periods.

Seasonal Pricing

A slightly more sophisticated version of rate management is the Seasonal Pricing Strategy. Rates are set based on a peak and off-peak calendar; however, consideration is giving to the shoulder months where demand may be a little higher than standard off peak rates. Occasionally property managers take into account weekend demand and price accordingly within the seasonal bands. Little or no consideration is given to real time demand.

Whereas this is an improvement on the fixed price approach, the vacation homeowner is still likely to miss out on revenue.

Dynamic Pricing

At Gulf Coast, we practice a dynamic pricing approach. Dynamic pricing itself can be split into three distinct areas, all of which need to be taken into account for a successful model.

Unit Specific Pricing

We manage a diverse portfolio of vacation homes; both in terms of type of property and location. The rental trend and pace of a one-bedroom beach front property on Longboat Key is very different to a four- bedroom pool home on a golf course in Venice. In determining rates, we take into account the location, size and type of property, rental restrictions (municipality and HOA or condo), local and community amenities. We finally taking into account unit specific features; all of which will impact the desirability of the property and the rates we are able to charge.

Increased Focus on Dates

The table below is an actual pricing table from one of our Siesta Key properties. You will see that the nightly rate varies throughout the month. The lowest nightly rate being $238 and the highest $356. The rates increase at the weekends and with this example month being September, the Labor Day weekend is priced significantly higher than the other weekends in the month. The Sunday before labor day is priced at over $100 more than the other Sundays in the month.

Real Time Demand

Dynamic pricing goes much further than increased granularity in property assessment and setting base rates. Perhaps the biggest factor in a dynamic pricing model is how the company reacts to real time demand. Using a combination of local knowledge and algorithms we adjust rates on a daily basis according to new data that we collect throughout the day. We utilize external data and internal data.

External data is sourced by comparing our rates with national, regional, and local accommodation companies; including other vacation rental homes (both company and self-managed), hotels and long stay corporate housing providers.

An example of internal data be factor localized specific demand, i.e., if we manage 10 units in one community and we see that as of April 2022, 8 of the units are already booked for January and February 2023 we will increase the rates of the 2 remaining units to capitalize on the obvious demand in that specific community.

Conversely, in times of low occupancy we would reduce rates, offer specials all in an effort to increase occupancy and ultimately avoid a lost revenue scenario.

This is true yield management; we publish higher rates when demand is strong, but reduce rates when demand weakens. This strategy guarantees our portfolio remains relevant and competitive every day of the year.

Another example of applying internal data to a rental rate strategy is by carefully analyzing booking windows. A booking window is essentially how far in advance guests tend to book properties.

Analyzing the booking window became especially important during the COVID pandemic. Florida experienced unprecedented demand for vacation rentals during the pandemic, but without a careful eye on the booking window data many companies were unable to capitalize on this demand.

Historically our average summer booking window was in excess of 70 days. This means that guests usually make their summer travel plans by April at the latest. During COVID we saw the average summer booking window drop to only 12 days. Uncertainty definitely prevented guests from making plans until the very last minute.

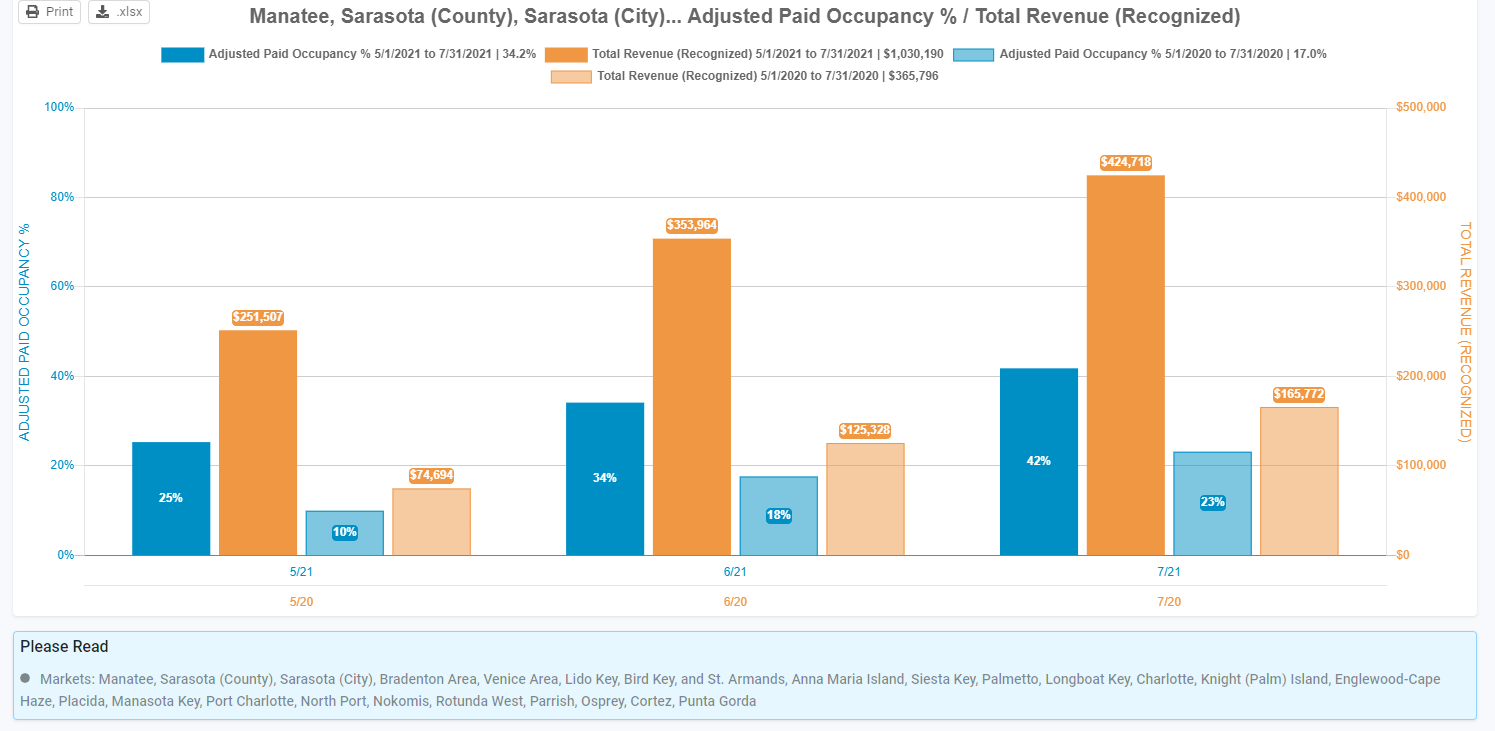

In ordinary circumstances with anticipated low occupancy, we would have reduced our prices and hoped that the lower rates would generate demand. However, by understanding booking trends we held our nerve, increased rates, and enjoyed the best summer in terms of occupancy and average daily rate in our company’s history. You will see on the table below that between May and July 2021 we increased occupancy by 100% and increased revenue by an astonishing 300%.

The solid blocks represent 2021 and the faded blocks with corresponding colors represent 2020.

What is the Right Price Point?

We are often asked, how much will you rent my property for? Given our rates change on a daily basis this is impossible to answer. The rate increase between the lowest rate during the quietist period of the year, and the highest rate in the busiest month of the year could be as much as 400%.

Whilst we do not provide specific rental rates, we do understand that vacation homeowners do need some guidance on income expectations. Therefore, instead of discussing rental rates, our approach is to discuss long term revenue goals. This approach affords our reservation team the latitude to react to changes in demand and market conditions without having to justify the logic behind every booking.

Just like the stock market, rates go up and down. Rather than sweating over daily rates, we believe establishing a realistic annual revenue goal and allowing our revenue and sales team to do reach (or even exceed) that goal, provides our clients with the best opportunity for vacation rental homeowner success.

.png)