Rent V Selling

In our 16 years of managing properties in Manatee and Sarasota counties we have witnessed firsthand, the boom and bust nature of the real estate market. As a result, we are often asked by homeowners whether they should sell their house now or hold on to it as an investment.

As a firm believer (and practitioner) of holding real estate to build wealth, my bias is going to be towards holding on to as much real estate as possible. I do recognize that some people are just not cut out to be landlords. Therefore, I will also discuss the benefits of selling.

The Case for Renting

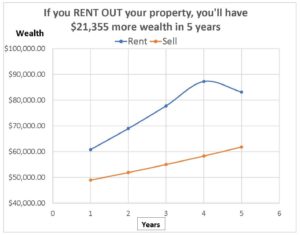

Before diving into the blog, I invite you to review the graph and table below.

These figures are just an example. To determine what renting versus selling looks like for you. Please click here for a personal assessment.

Since many of the factors impacting return are out of your control (e.g. changes to the tax benefits of owning real estate, interest rates, condition of the property, real estate market, and so on), it is critical that you make the decision as to sell or rent after considering what your larger financial goals are. You should include property ownership in the context of your overall investment strategy.

As a professional rental manager, I am amazed when property owners list the property for sale and rent at the same time. Considering the variants between the two options, this ‘flip of the coin’ approach demonstrates a lack of understanding on the implications of both options. I want to change that mindset and help property owners make better informed decisions.

The tax reform legislation which came into effect in 2018 has made significant changes to the benefits of holding real estate as a primary residence and as a landlord. Some of the changes that will negatively impact homeowners are state and local tax deductions (including property tax) are capped at $10,000. Interest paid on home equity debt may still be tax deductible, provided that the proceeds of the loan are used to "buy, build or substantially improve the taxpayer’s home that secures the loan." Beginning in 2018, mortgage interest and qualified home equity debt interest will only be tax deductible on new home loans up to $750,000.

Where homeowners may have lost out in the Tax Cuts and Jobs Act, real estate investors have benefited. Many of the key points in the new tax code that hurt homeowners will likely not apply to landlords. Rental property ownership is considered to be a business by the IRS. Landlords of residential property are not subject to the same limits as homeowners regarding the deductibility of property taxes and mortgage interest.

The new tax bill also included a provision where landlords are entitled to up to 20% on their "pass through" income. This will benefit investors that own their properties as an individual, limited liability company (LLC), or partnership. Income limits and other rules do apply. It is vital that you work with a tax advisor who understands these new rules and how it impacts your overall financial picture.

Renting (or continuing to rent) your house may make sense if you agree with the following:

You see the Big Picture: A renter is paying your mortgage. There I’ve said it. It is not just about the end of the month cash flow. Your end of month cash flow might be $200 short but if you are paying down $1000 a month capital, then you are net $800 per month better-off. This is without all of the other tax advantages that come with rental ownership.

The cash flows work (even kind of): Generally, you want your expected rental income to cover your regular expenses (e.g. mortgage, property taxes, ongoing maintenance, HOA dues). This will allow you to add to your personal reserves for unexpected repairs. Be sure to consider the after-tax assessment which includes the depreciation and other potentially tax-deductible expenses.

You have strong cash reserves and regular income from outside sources: What is your capacity to make unexpected repairs or handle vacancies without impacting your other goals or regular financial obligations? Real estate is a notoriously illiquid and cash-intensive asset. Having strong cash reserves in addition to a regular emergency fund is necessary.

Financially, you don't really need to sell: Perhaps you plan on renting yourself or have other sources of cash for a down payment on another home. Even if you don't foresee any immediate cash needs, you should ensure property investment fits within your larger investment goals.

You want a Balanced Investment Portfolio: Holding real estate is a great way to diversify your investments, as long as it doesn't become too big of a part of your overall net worth. Many financial advisors subscribe to the 25% investment strategy.

- 25% Pension/Retirement Funds

- 25% Real Estate (Investment not primary)

- 25% Securities

- 25% Equities

Ok, so I may have started to convince you that holding on to real estate is a good thing, but what if the market crashes?

Do you sell your stocks every time there is a dip? If the answer is no, then why don’t you treat your real estate investment portfolio in the same manner? As with the stock market, the value of the property is only realized when you sell the asset. We currently manage many properties where the owner was under water in 2008, but they came through the crisis. These owners' properties returned to pre-crisis value, simply by renting them out. More to the point, their credit remained intact, and they were able to write off virtually all expenses and their mortgage has been paid down significantly. They now sit on an appreciating asset where a renter is paying their mortgage down. This will be a great annuity later in life or a legacy they pass down to the next generation.

I understand that the ghosts of 2008 are ever present in most homeowners’ minds. The pain was real for everyone and many people lost their shirts in an overheated property market. While this is sad and many people still haven’t recovered, the crisis proved to be a good thing for many real estate investors. There were some other positives that came out of the financial crisis.

- More stringent lending criteria

- A new generation of investors were born

- A more professional approach to rental management was required

The Case for Selling

Cash Flow Reasons: Although there are ways to come up with a down payment and buy another home before selling the old one, it doesn't work in all situations. Even if the down payment isn't an issue, perhaps you find the after-tax cash flows don't work or aren't worth the hassle and risk of keeping the property.

Fund other goals: If you can avoid plowing all of the proceeds from the sale of your home into your next property, the windfall could make a meaningful impact on your other goals. Consider getting caught up on your retirement savings by putting the proceeds in a brokerage account or funding the kids' 529 college savings plans.

Cut your losses: Home buyers who have been underwater in their house may be eager to jump at the chance to break even and start over or sell when their losses are minimized. Another reason could be the condition of the property. Cars aren't the only thing that can turn out to be a lemon. If the property was a money pit while you were living there, it may only get worse when rented. Maybe you were willing to shower at the gym for a week or two while you wait for the new hot water heater to be installed. Just know that your tenant won't be quite as sympathetic.

Tax benefits: Although it was on the chopping block in the initial drafts of the 2017 Tax Cuts and Jobs Act, the home sale exclusion on a primary residence managed to survive the final bill. If you own the home and have lived in it as your primary residence for at least two of the last five years, you may be able to exclude all - or a portion of - the gains from capital gains tax. Single filers may exclude gains up to $250,000 ($500,000 if married filing jointly) from their taxable income. Depending on your tax rate and projected gains/rental income, it could take decades to recoup the lost tax-free profits by choosing to rent your home instead of selling it as a qualified primary residence. Any of the provisions in the new tax legislation could change under the next administration, including the new additions that are favorable to landlords. The key takeaway is that the tax code can change at any time, even radically as we have just seen. If the success of your strategy hinges on the continuation of any favorable treatment of real estate in the tax code, proceed with extreme caution.

Increasing expenses and other impacts to profitability: You may be in a situation where your projected cash flow looks strong in the next year but you aren't sure it will last. There are a number of factors outside of your control that can impact profitability over the long term. These expenses could come in the form of increased property taxes, homeowner’s association (HOA) dues, special assessments for repairs in condominium associations, and repairs/upgrades on an aging property.

Keep monthly costs low: While weighing the decision to sell your home vs renting it out, also consider how keeping the property may impact your monthly mortgage payment on the new home. If you need to, put less than 20% down to make it work. It will very likely impact the interest rate lenders offer you and could trigger private mortgage insurance (PMI), which could stay with you for the life of the loan. The new tax bill also reduced the limit on mortgage interest deduction. This deduction is now limited to $750,000 of debt for new loans and there is no longer an interest deduction for home equity loans.

Your home is already the bulk of your net worth: Depending on your other investments, your home may already be a large part of your net worth. If this is the case, it may not be wise to substantially increase the proportion of real estate in your overall investment mix by renting the property and buying another home to use as a primary residence. Selling the home can allow you to use some of the proceeds to diversify your investments.

Conclusion

Ultimately there is no right or wrong answer. You must make sure you make the best decision for you. Hopefully now you can do it from a better-informed perspective. I will be happy if all I’ve done is make you pause and think, if even for a second.

Writing with my rental manger’s head on, I do know that you own property in one of the most beautiful and desirable areas in the US. People will continue to flock to this area for decades to come.

The trend of moving to Bradenton, Lakewood Ranch, Sarasota or Venice can be compared to the popularity of people moving to San Diego on the West Coast. I would take a good look at what has happened to property values and rents in San Diego. I find it difficult to believe anyone with a keen eye on building wealth would easily give up their own slice of paradise on the Gulf Coast, whether it be purely for investment motives or the desire to one day move back.

.png)